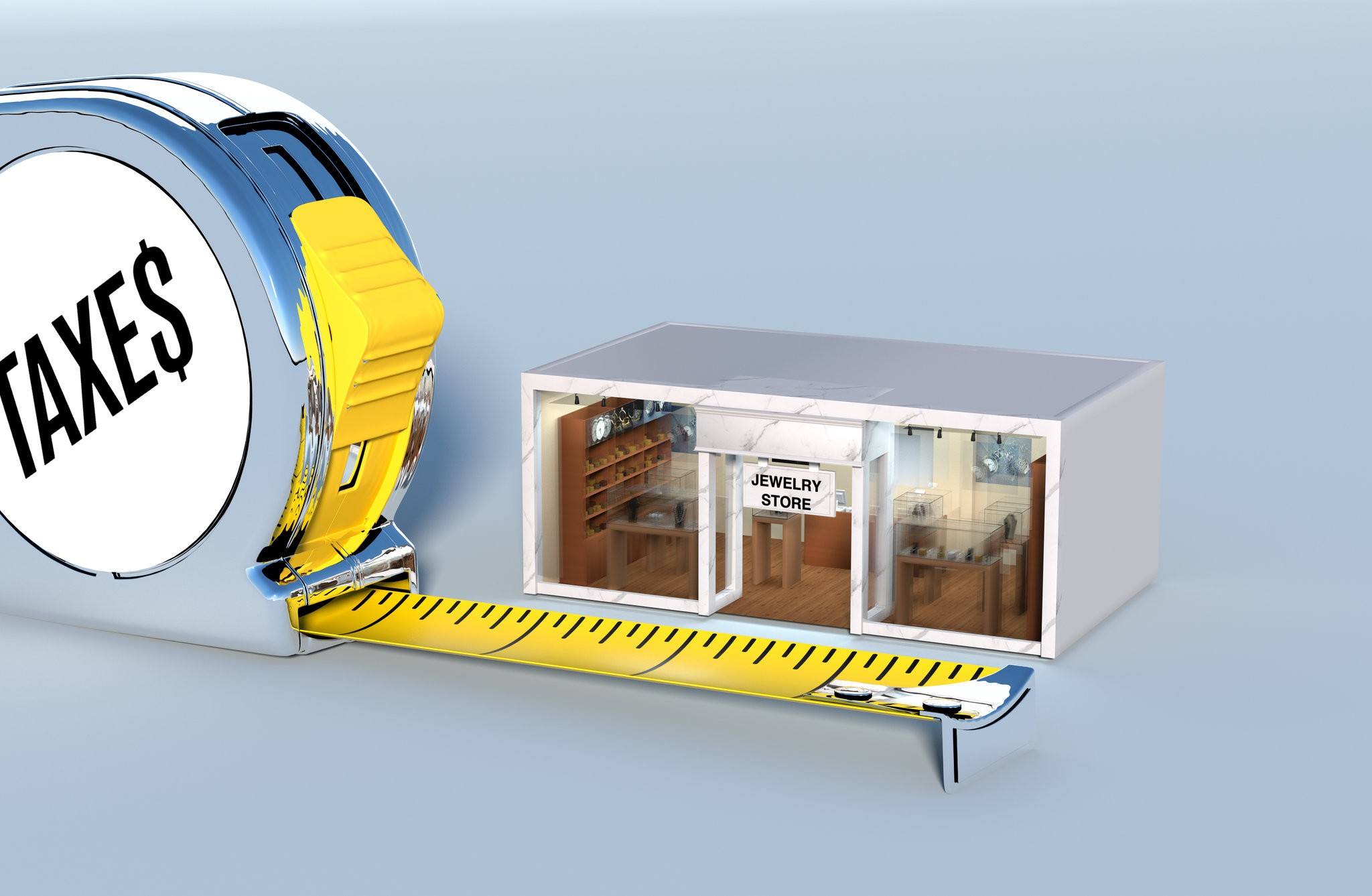

Small Businesses Have a New Tax Break, but There Are Many ‘Ifs’

This article was originally published by the New York Times

Photo by Delcan & Company + Saad Moosajee

Small businesses may be able to receive a big tax break this year, thanks to the new rules. They also may face a big headache: figuring out whether the tax break applies to them.

The problem is that a centerpiece of the legislation is a write-off for “qualified business income,” but it’s unclear whether certain activities count. That is sowing confusion as the April deadline for filing the first returns under the law approaches.

“Parts of the law were not well thought out,” said Lisa Goldman, a partner in the international tax practice of the accountancy Berdon L.L.P. Congress was in a rush to enact the law before the end of 2017 and was more concerned, she said, with big businesses than small: “I’m not surprised it’s convoluted.”

While the Internal Revenue Service issued additional clarifications in January, much of the uncertainty continues, often focused on a 20 percent deduction for qualified business income.

It is available for many sole proprietorships, partnerships and pass-through entities, such as S corporations. Most small businesses are formed under one of these structures, and most are eligible for the deduction. But not all of them are.

First, the relatively simple part: Businesses generally can receive the full deduction if their owners are married and file jointly and their taxable income does not exceed $315,000, or half that amount for single filers. More than 90 percent of pass-through entities qualify for the deduction, said Mark Jaeger, director for tax development at TaxAct, a provider of tax filing software.

“If you’re a typical business owner, your net profit on Schedule C is going to be qualified business income,” he said. Schedule C of Form 1040 is where individuals report business income.

“Don’t even worry about it if your income is under those amounts,” Mr. Jaeger said. And a partial deduction is available on incomes up to $415,000 for people who file jointly, or $207,500 for single filers.

The complications are mind-numbing

But it’s not just qualified business income that’s used to figure eligibility for the deduction; it’s also total taxable income. So if you make $250,000 in your business and your spouse makes $200,000 in a salaried job, the total income on your return is $450,000. In that case, you could lose the qualified business income deduction.

Not necessarily, though.

If you pay wages to employees, including yourself, you could be eligible to take a qualified business income deduction equal to 50 percent of those wages, even if your income exceeds the threshold. In any case, the deduction cannot be more than 20 percent of qualified business income.

If your head isn’t spinning yet, there is more: An alternative calculation allows real estate firms to claim a qualified business income deduction of 25 percent of wages and 2.5 percent of the amount invested in property. But that’s only available if the I.R.S. deems the enterprise an eligible business. The agency last month ruled that renting out property is a business for which the deduction applies, and is not just a passive investment, under certain circumstances. Separate books and bank accounts must be kept and 250 hours a year must be devoted to active management, the agency said.

There’s still more fine print. The deduction is out of bounds to anyone who has income above the threshold and runs what the law calls a “specified service trade or business.” That’s one whose main asset is the owners’ reputation and skill.

The law lists several examples, including health, law, financial services, entertainment and consulting. Those businesses don’t qualify for the deduction. But for some reason, architecture and engineering do.

In the batch of rules released last month, the I.R.S. acknowledged that some activities can go either way, such as the operation of a pharmacy. The question for pharmacies is whether owners are regarded as dispensing health care. The I.R.S. said it depended on the circumstances.

‘Interesting anomalies’

Ian Shane, a partner at the law firm Michelman & Robinson, said: “As these final regulations are put into effect by tax practitioners, I am confident that there will still be a substantial number of gray areas where it comes down to anybody’s guess as to whether the activity or type of business will qualify for the deduction in the eyes of the I.R.S.”

Mr. Shane highlighted some “interesting anomalies.” One is whether a business engages in consulting, which disqualifies it for the deduction. Providing training courses or related services qualifies for the deduction, but providing advice and counsel — which can be part of training — constitutes consulting, in the agency’s view. What a business puts on its invoices and how it has represented itself over the years will go a long way to determining how it’s regarded, he said.

For an entrepreneur like Paige Cornetet, the distinction might amount to considerable money. Her business, Millennial Guru, which she started a year and a half ago in Grand Rapids, Mich., provides workshops and one-on-one training to help companies manage younger employees better. She runs Millennial Guru as a sole proprietor.

Ms. Cornetet’s adviser, Greg Rosica, a partner in Ernst & Young’s private client services practice, said Millennial Guru is clearly an education business, adding that he is not worried that the I.R.S. will view it as a consultancy. In other words, he says, the business should be eligible for the deduction.

Ms. Cornetet said the various breaks in the tax bill have saved her enough to pay for a full-time assistant, allowing her “to have fewer things on my plate, focus on what I’m good at and stay in my lane.”

Mr. Shane encourages entrepreneurs to use a tax professional to help accomplish those same objectives and to navigate the law generally.

“There are so many questions you don’t know how to answer, especially about what’s a qualified trade or business,” he said. “Go to an accountant. You don’t want something disallowed because you didn’t do one little thing.”

Leave a Reply

Want to join the discussion?Feel free to contribute!